Understanding Total Cost of Ownership for Energy Assets and Infrastructure

It’s a challenging time for companies. Nationally, organizations across industries are struggling to tighten their budgets, optimize operations and accomplish goals for resiliency and efficiency. One place that is often overlooked is a thorough assessment of costs related to owning and operating critical energy assets.

So many organizations allocate time and effort to manage energy and utilities in the hopes of minimizing disruption. In doing so, they perform these tasks at the expense of revenue-generating activities that are core to their business plans.

The infrastructure-as-a-service model is a cost-effective option that can boost return on investment (ROI) because it stabilizes cash flow, makes your costs more predictable and defers capital expenses. Most electrical and mechanical assets have a known useful and efficient life, and the concept of maintaining these assets within an as-a-service program is simple. Infrastructure as a service combines all expenses related to delivering this useful life into a single monthly payment that does not escalate over time. Best of all, the burden and costs of unexpected risks, failures, escalation and inflation are transferred to the service provider.

Keep reading to learn how to evaluate your company’s total cost of ownership, how a managed energy service can help meet your needs and how companies nationwide are leveraging it to help streamline their budgets and operations.

What Is Your Total Cost of Ownership for Energy Infrastructure?

Many organizations recognize the considerable upfront costs that come with building or renovating energy infrastructure but may not account for the fact that critical energy assets need regular, ongoing maintenance. If that maintenance is deferred, you can end up with more significant costs as time goes on. Ownership comes with maintenance and labor costs that grow over time, but there are costs you may not consider when making energy asset investments.

To better understand your company’s current investment, consider both direct and indirect costs for your critical energy assets. These costs include:

- Costs associated with interruptions and unplanned downtime

- Missed shipments and contractual penalties

- Reduced machine performance

- Quality and rework

- Safety implications associated with restarts

- Operating and maintenance costs

- Capital investments/cost of capital

- Overhead (asset management, scheduling, warranty claims)

- Asset monitoring and testing

- Fuel certainty expenses

- Added insurance cost

- Opportunity cost and costs related to inefficient operations (energy and maintenance)

Determining Your Payback and Return on Investment

All capital investments (CapEx) are heavily scrutinized. But how can you determine whether or not you’re making the right decision with energy asset management? Often, owners divide the acquisition costs by the annual saving and determine project viability by the number of years it takes to ‘break even.’ While this is a good rule of thumb to consider high-level project viability, it generally does not work with electrical and mechanical infrastructure. These assets require routine maintenance and oversight to operate efficiently, impact energy costs, impact business operation and carry a high level of risk associated with reliability and premature failure. So, let’s begin the journey to best evaluate a successful project. As with any major project, understanding the return on investment (ROI) on energy assets is critical. Simple paybacks, internal rate of return (IRR), net present value (NPV) – there are several ways you can evaluate your ROI.

For example, let’s say you are considering a combined heat and power (CHP) system and need to know the 10-year payback. If self-performing, you’ll likely see some savings (e.g., electricity and steam savings) but you’ll also be hit with significant costs (e.g., unplanned capital expenditures, uncertain gas escalation costs, unplanned overhaul and ongoing maintenance, labor escalation costs, etc.). But outsourcing that risk to a trusted energy provider using an operating lease mitigates risk and frees up capital for other projects or customer-focused investments.

This consideration is largely the same for other energy projects like backup power and updated infrastructure for future energy needs. In both cases, a major upfront investment is required, and maintenance and fuel costs can be significant over time. The opportunity cost of not pursuing these projects can be massive, though. If reliable backup generation isn’t available in case of an outage, your business and the people you serve can suffer. If you choose not to invest in future-proofing your energy infrastructure, your business may be ill-equipped to adopt and support emerging technologies like automation and robotics. Without the sufficient energy infrastructure in place, organizations risk wasting investment in new technology.

So, how do you know you’re making a sound financial decision by owning and operating your own highly technical energy assets? A good rule of thumb is to comprehensively evaluate your investment using:

- Simple payback: This simple calculation will help you and leadership better understand how long it will take until you earn your money back from the investment. You can quickly calculate this by dividing the initial investment cost by annual savings to give you the total payback period.

- Net present value: This is the sum of present value and the initial investment.

- Internal rate of return: This is often used in capital budgeting to estimate profitability. It’s the annual rate of growth that an investment is expected to generate.

Analyzing Your Total Cost of Ownership for Energy Assets

A customer in the education sector had a history of deferred maintenance and letting equipment run to failure. They reached out to the Duke Energy Sustainable Solutions (DESS) team for a potential long-term solution.

Customer’s needs:

- Cost predictability

- Capital conservation

- Worry-free operation

- Energy management and construction expertise

How DESS meets customer’s needs:

- Flat/fixed monthly payments with flexible contract terms

- Zero initial capital required

- DBOOM model for mitigating risk and managing assets

- History of successful projects

- Full custom design processes

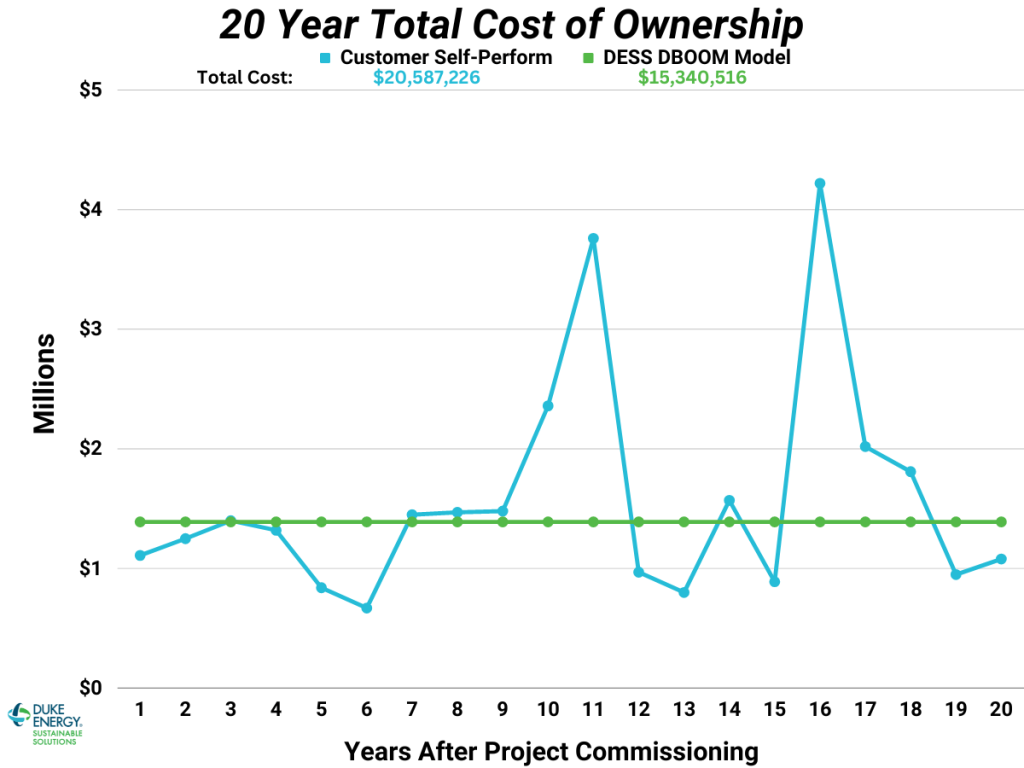

Let’s consider the total cost of ownership for a hypothetical combined heat and power (CHP) project assuming a discount rate of 12% as well as 3% inflation and 7% cost of capital. A total cost of ownership (TCO) analysis was performed by forecasting 20 years of exactly how the customer is handling their equipment today versus a DESS implemented design, build, own, operate, maintain (DBOOM) solution. The result was a grim outlook for the customer if they were to continue to operate as they historically have.

DESS DBOOM Benefits:

- Approximately $4.68 million or 23% savings versus customer self-perform

- O&M cost predictability/stability

- Capital preservation for higher ROI opportunities

- Redeployment of existing maintenance personnel

Customer self-perform subject to cost volatility year over year. Peaks represent large equipment purchases.

Our analysis considered the customer’s capital cost, escalation, overhead, insurance, preventive maintenance costs, emergent maintenance costs, customer labor rates, and more. This analysis accounts for equipment overhauls due to deferred maintenance in years 11 and 16. Please note that the timing of these major overhauls can vary due to several factors in addition to the maintenance schedule.

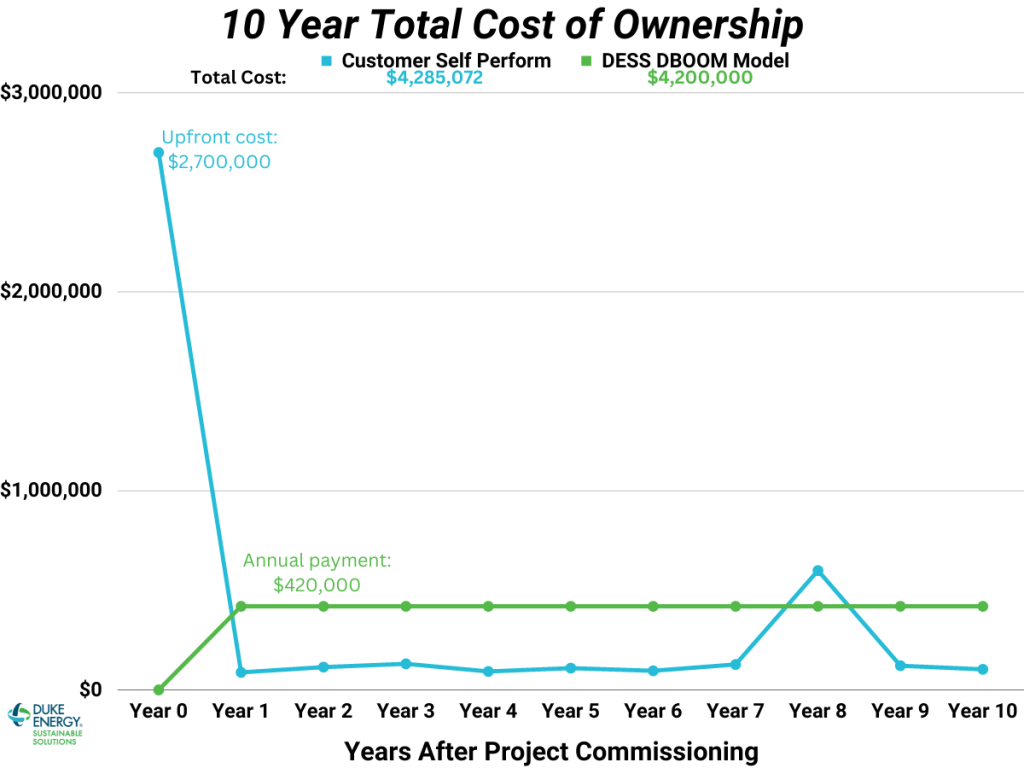

Running a TCO analysis is also useful for energy resilience projects that have a lifespan shorter than 20 years. With that in mind, let’s consider another hypothetical project assuming a discount rate of 8% and inflation of 3% spanning 10 years. With a customer handling the buildout, a major upfront capital expenditure would be needed for the purchase of backup generation and electrical equipment plus the labor to complete the build.

Customer self-perform subject to major upfront expenditure. Peak in year 8 represents maintenance spike.

With the customer performing the project, this major expenditure occurs before the system is even deployed. On the flipside, a DESS DBOOM solution eliminates the need for that significant upfront purchase and distributes the cost evenly across the 10-year life of the project. The DBOOM model also covers the business for maintenance on the resiliency equipment. This means that the spike in cost predicated in year 8 would be handled by DESS at no additional cost to the business. Over the life of this hypothetical project the customer would save nearly $90k in expected costs and gain peace of mind that their backup generation system is always ready to deliver.

TCO analysis is critical because it provides a holistic view of a project. It allows customers to deploy capital directly on higher return on investment (ROI) projects. It also converts the payment into an O&M expense. DESS can also work with customers on tiered or planned payment increases to gradually work the project into budget cycles.

The Benefits of Resiliency as a Service

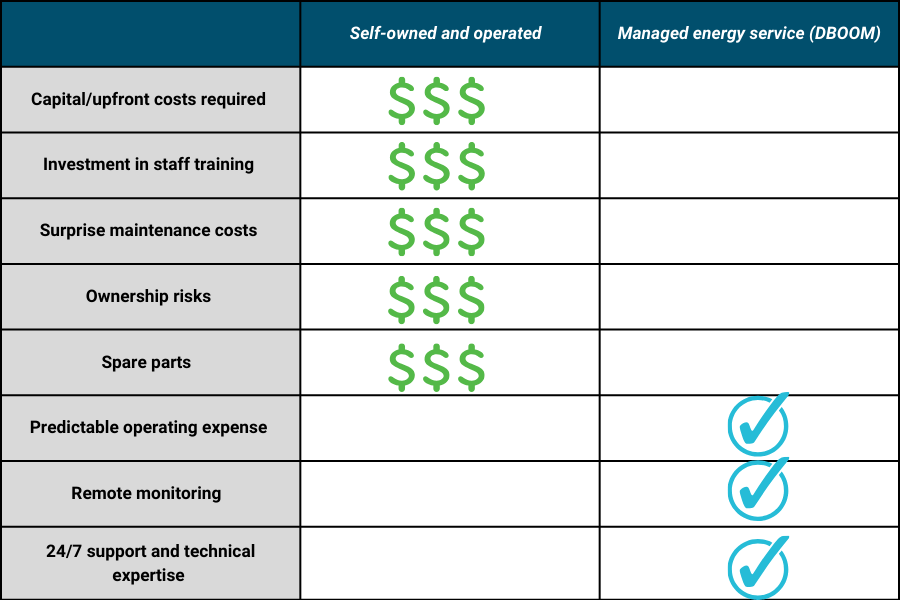

You can see illustrated in the TCO analysis above that self-performing and operating energy assets is an uncertain proposition for most organizations. There are several benefits that businesses experience when shifting their energy asset management to resiliency as a service like DESS’ DBOOM model.

Budget certainty

Say goodbye to unpredictable price fluctuations and surprise costs. With resiliency as a service, you’ll have a predictable monthly payment over the life of your contract. That gives you protection against rising interest rates and inflation as well as budget flexibility to invest in other parts of your business

No upfront capital required

Break the cycle of competing with other business priorities. Our energy infrastructure projects help eliminate project deferment by shifting your assets from large capital expenditures to a predictable operating expense. This reduces the amount of upfront funds needed and frees up resources for more pressing business needs like increasing inventory and adding new production lines, automation and robotics.

For many organizations, the cost of buying, operating and maintaining their own energy assets is a much higher financial investment than they realize.

Technical expertise

Get right-sized energy infrastructure solutions for your evolving business needs with maintenance provided by our team of energy professionals. This relieves your team from having to invest in staff training while providing you with the technical expertise you need to protect your business from costly power fluctuations and equipment damage. Our team works with you from design to commissioning and beyond to help meet your energy needs.

Risk

At the end of the decision-making journey, if you are not yet convinced, consider the elements of risk. History teaches us that risk is real. Whether generated by a world crisis like a pandemic, political/international turmoil or natural disaster, we have learned to expect the unexpected.

Risk also lurks inside our ability to provide the proper attention to maintain critical assets and even the ability to hire competent labor in the future, not to mention the risks of hiring a great contractor or the unfortunate experience of purchasing an asset that misses the mark in performance. It is important to assign a value to risk. Though often unaccounted for in your self-operation plans, risk can be much more costly than initial capital and cost of money across time.

Finding the RIGHT Answer

The decision-making process can be difficult. Allocating time and resources to such a complicated task can seem daunting and paying consultants can increase project costs. Our teams in engineering, structuring, risk and operations professionally and swiftly guide you through the process to find a viable and affordable project.